Interest rate return on investment calculator

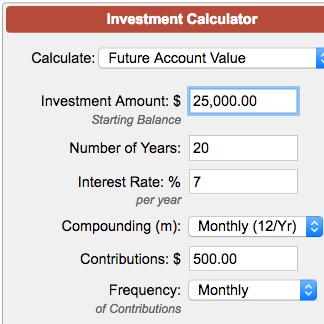

You may want to adjust your contribution rate. Simple interest is the interest earned on the principal amount invested at the predetermined interest rate during the investment tenure.

How To Calculate The Return On Investment Roi Of Real Estate Stocks Youtube

Compound interest is the addition of interest to the principal sum of a loan or deposit or in other words interest on principal plus interest.

. To maintain the value of the money a stable interest rate or investment return rate of 4 or above needs to be earned and this is not easy to achieve. From the graph below we can see how an investment of 100000 has grown in 5 years. To calculate the rate of return on an investment or savings balance we use an adapted version of the compound interest formula used in our calculators.

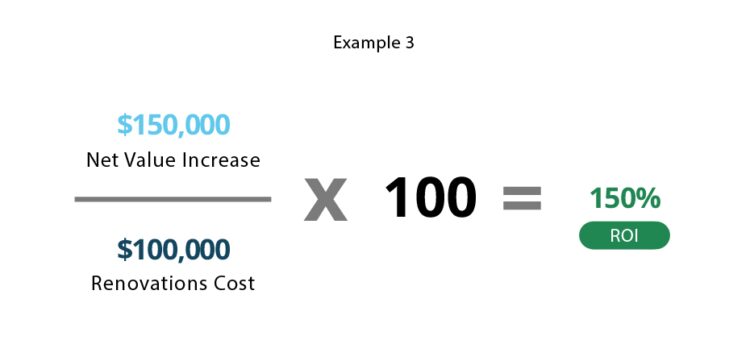

Annualized Rate 1 ROI over N months. N Number of Monthly Payments for 30-Year Mortgage 30 12 360 etc How to Use Our Mortgage. A high ROI means the investments gains compare favourably to its cost.

In compound interest one earns interest on interest. Use our Interest Rate Converter Calculator to quickly convert Annual Percentage Rates to monthly interest rates and monthly interest rates into an APR. The bank has offered him three interest rate plans Quarterly Interest Rate of 1 Half-Yearly Interest Rate of 2 and.

This move follows a 75 basis-point hike in. Bajaj Finance is offering higher interest rates in India. Fixed Deposit Interest Rates.

Investment returns are typically shown at an annual rate of return. Learn more about an investment professionals background registration status and more. For those who want to know exactly how our calculator works we use the following formula for our mortgage calculations.

Calculate the savings and interest on a systematic investment plan at the end of investment. P Principal Amount initial loan balance i Interest Rate. FD Calculator to Calculate the Return and Fixed Deposit Interest Rates on your investment.

Does This Calculator Account For Tax Charges Associated With The Annuity. Return on investment calculator. Free interest calculator to find the interest final balance and accumulation schedule using either a fixed starting principal andor periodic contributions.

Internal rate of return is also called the annualized rate of return. Compare Simple vs Compound Interest. No this annuity return calculator does not factor taxes into the.

Formula for calculation. Effective Interest Rate Calculator. Range of interest rates above and below the rate set above that you desire to see results for.

Annual Interest Rate of 4. Now help John to decide which plan will offer him the best real interest rate if the inflation rate during the period is expected to be 2. Note that our interest rate calculator uses monthly compounding.

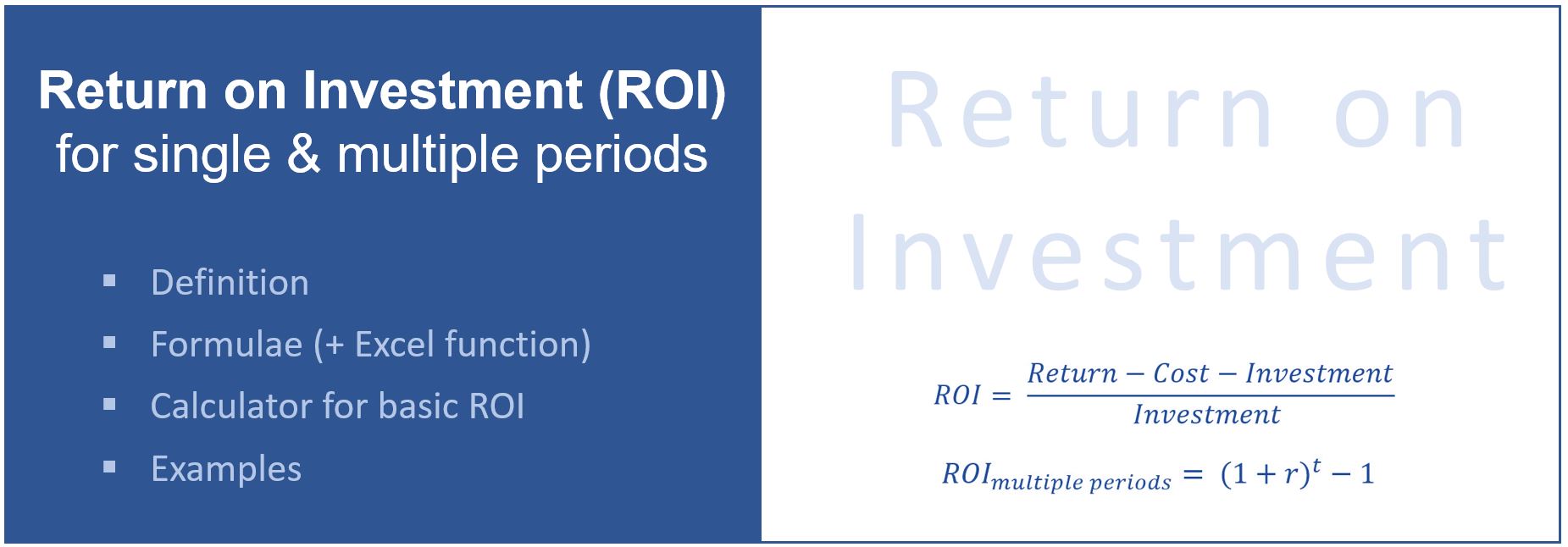

It is the result of reinvesting interest or adding it to the loaned capital rather than paying it out or requiring payment from borrower so that interest in the next period is then earned on the principal sum plus previously accumulated interest. As a performance measure ROI is used to evaluate the efficiency of an investment or to compare the efficiencies of several. Use Forbes Advisors return on investment calculator to help plan your long-term in.

The average stock market return is historically 10 annually though that rate is reduced by inflation. We enter into the formula your current balance original principal amount number of compounds per year and time period and. Interest rate variance range.

The higher the ARR the higher the profitability of a project. On July 27 the Federal Reserve announced another big rate hike raising the federal funds rate by 75 basis points bps to a range of 225 to 25. When compounding of interest takes place the effective annual rate becomes higher than the nominal annual interest rate.

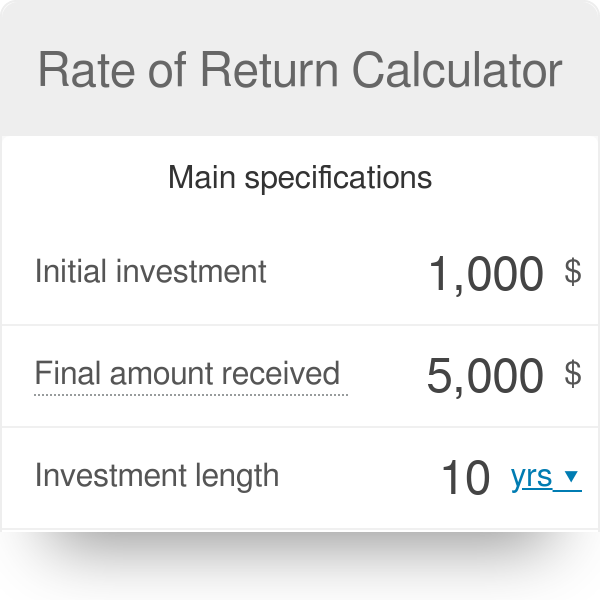

Check current FD rates and get complete details about Bajaj Finance FD rates for customers below 60 years of age Senior Citizen Invest in FD and get returns upto 775 pa. Find out the interest earned on a monthly investment plan at a certain rate of interest. An annualized rate of return is the return on an investment over a period other than one year such as a month or two years multiplied or divided to give a comparable one-year return.

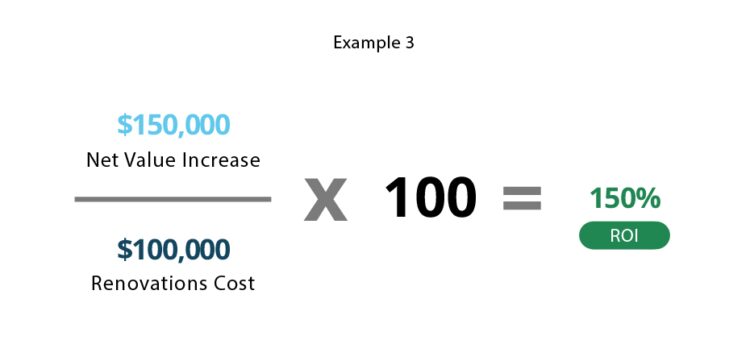

The Investment Calculator can help determine one of many different variables concerning investments with a fixed rate of return. Return on investment ROI or return on costs ROC is a ratio between net income over a period and investment costs resulting from an investment of some resources at a point in time. This Investment Return Calculator helps you in calculating the return on savings and investments.

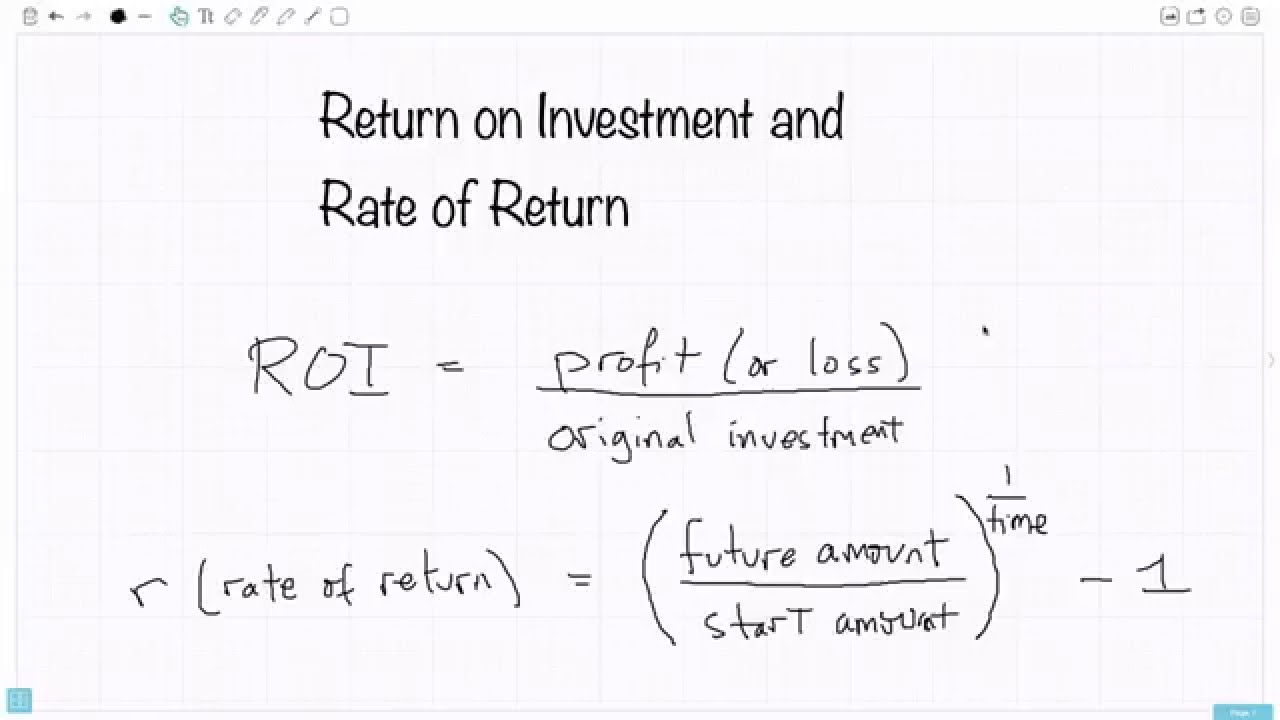

IRR measures all cash flows in and out of the investment to calculate the interest rate. On the surface it appears as a. IRR stands for internal rate of return.

If you have an investment earning a nominal interest rate of 7 per year and you will be getting interest compounded monthly and you want to know effective rate for one year enter 7 and 12 and 1. Your estimated annual interest rate. You want to know what your return will be in 5 years.

It is the basis of everything from a personal savings plan to the long term growth of the stock market. You can also sometimes estimate the return rate with The Rule of 72. With so many different short-term loan vehicles and other financial products available to consumers deciphering the interest you are paying or the interest that is being paid to you can be very difficult.

For any typical financial investment there are four crucial elements that make up the investment. The Math Behind Our Mortgage Calculator. See the CAGR of the SP 500 this investment return calculator CAGR Explained and How Finance Works for the rate of return formula.

Calculating ARR or Accounting Rate of Return provides visibility of the interest you have actually earned on your investment. An investment of 100000 at a 12 rate of return for 5 years compounded annually will be 176234. Calculate the growth of your investment based on interest rates.

Return rate For many investors this is what matters most. M Monthly Payment. The formula for calculating average annual interest rate.

Input your investment amount FD Period Interest Rate to know your mature amount. Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance. Whether its a new project pitched by your team a real estate investment a piece of jewelry or an antique artifact whatever you have invested in must turn.

The more times the interest is compounded within the year the higher the effective annual interest rate will be. P is principal I is the interest rate n is the number of compounding periods. Effective Interest Rate Calculator.

.jpg)

Return On Investment Roi Formula Meaning Investinganswers

Roi Calculator Formula Investing Financial Management Online Advertising

Investment Calculator

Rate Of Return Formula Calculator Excel Template

Rate Of Return On Investment Calculator Hot Sale 58 Off Www Ingeniovirtual Com

How To Calculate Roi On A Business Loan Moula Good Business

Return On Investment Roi Definition Equation How To Calculate It

Return On Investment Roi Formula And Excel Calculator

Return On Investment Single Multi Period Roi Formulae Examples Calculator Project Management Info

:max_bytes(150000):strip_icc()/dotdash_Final_Inflation_Adjusted_Return_Nov_2020-01-c53e0ae26e8f404fb1ce91a9127cbd3b.jpg)

Inflation Adjusted Return Definition

Return On Investment Roi Formula Meaning Investinganswers

Rate Of Return On Investment Calculator Hot Sale 58 Off Www Ingeniovirtual Com

Return On Investment Definition Formula Roi Calculation

Rate Of Return Calculator

Return On Investment Roi Definition Equation How To Calculate It

Calculating Return On Investment Roi In Excel

Return On Investment Roi Formula And Excel Calculator